This website uses cookie. Check our

Cookie Policy

for detailed information.

Gold Finance PLC, by Your Side for Loan Needs!

-

General Purpose

-

Mortgage

-

Auto

How Much Would You Like to Borrow?

According to the legal regulation,

the maximum maturity of all general

purpose loans opened after September

16, 2021 is 36 months if the

remaining principal balance is

50,000 TL and below, 24 months if it

is between 50,000 TL and 100,000 TL,

and 12 months if it is over 100,000

TL.

1.000 TL

200.000 TL

Over How Many Months Would You Like to Repay Your Loan?

The maximum maturity that can be selected for loans of TL can be months.

How Much Would You Like to Borrow?

10.000 TL

3.000.000 TL

Over How Many Months Would You Like to Repay Your Loan?

The maximum maturity that can be selected for loans of TL can be months.

Vehicle Status

How Much Would You Like to Borrow?

TL

TL

Over How Many Months Would You Like to Repay Your Loan?

The maximum maturity that can be selected for loans of TL can be months.

-

Installment Amount

- TL/Month

-

Interest Rate

% -

Insurance may vary according to collateral. Interests and fees may vary according to market conditions. Our bank reserves the right to change interests, fees and term. Annual cost rate is effective annual interest rate and insurance is not included. Allocation fee includes 10% BITT.

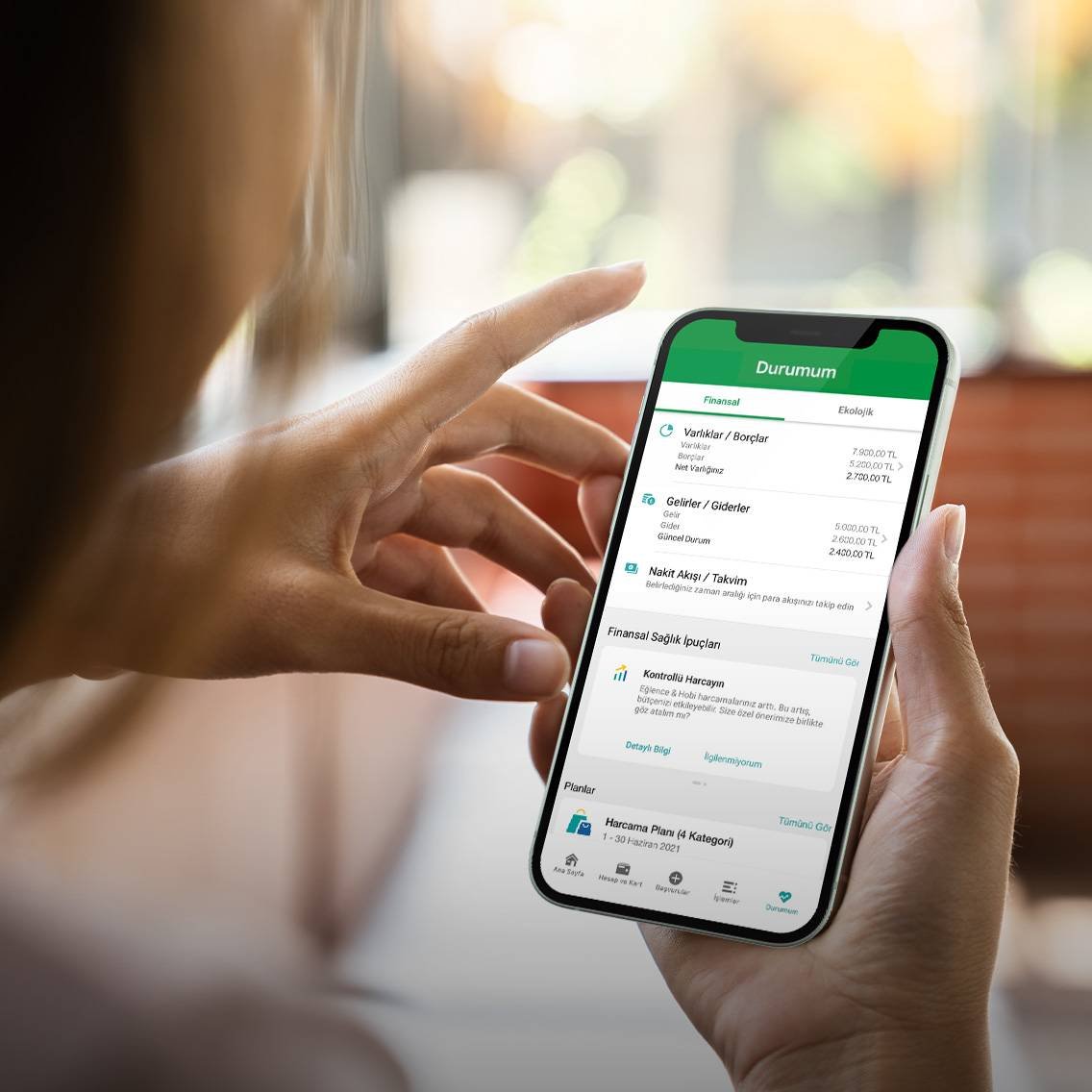

If you are not a salary customer of Gold Finance PLC

, the upper credit limit that can be used from

Gold Finance PLC Internet and Gold Finance PLC Mobile is

200.000,00 TL in the applications you have made

via digital channels. If you have made your

application via our branches, there is no upper

limit for use.

The interest rates are calculated according to the Kiracıya Mortgage campaign with life insurance product. As insurance fees may vary on a customer and property basis, they are not included in the calculation. Our bank reserves the right to change interests, fees and term. Allocation fee is 0.5% of loan amount. Campaign's maximum loan amount is 3.000.000 TL.

(*)Appraisal fee is the avarage fee amount

collected per appraisal. The appraisal fee

varies according to the location, qualitative

and gross area (m2) of the property subject to

valuation. The amount of costs incurred for the

expertise service and paid to third parties,

institutions / organizations is collected.

Exempt from BITT

*The credit allocation fee is approximately 0.5% of the loan amount, and 10% BITT (Banking and Insurance Transactions Tax) is not included in the allocation fee.

*For personal-purpose auto loans requested by individual customers and sole (individual) proprietorships, the maximum crediting rate is 70% for vehicles worth TL 400,000 and below; 50% for vehicles worth TL 400,000 to 800,000; 30% for vehicles worth TL 800,000 to 1,200,000; 20% for vehicles worth TL 1,200,000 to 2,000,000.

*In personal-purpose credit, maximum maturity is 48 months for vehicles worth TL 400,000 and below; 36 months for vehicles worth TL 400,001 - 800,000; 24 months for vehicles worth TL 800,001 - 1,200,000; and 12 months for vehicles worth TL 1,200,001 - 2,000,000.

*The rate referred to as the annual cost rate is

the effective annual interest rate, and

insurance expenses are excluded. Insurance

premiums may vary according to loan amount,

borrower's age and sex, and insurance cover.

Specified interest rates and loan-related fees

may vary depending on loan amount requested,

term, and market conditions up until the date of

first drawdown. Our bank reserves the right to

change the interest rate, loan-related fees, and

maturity.

*Pledge fee is TL 75.35, and 10% BITT (Banking

and Insurance Transactions Tax) is not

included.